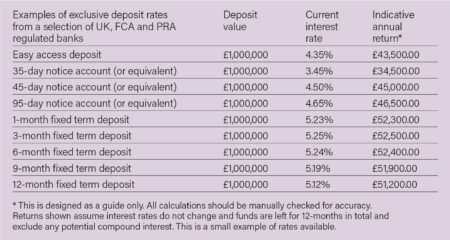

Bank deposits – April 2024

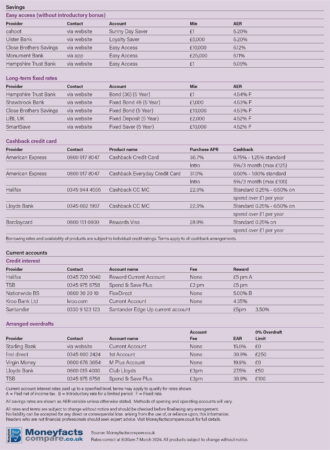

In a new regular series, we provide the latest best rates for bank deposits. Ian Buss accesses those from deposit platforms, while MoneyFacts offers the best rates it has identified

At the time of publication, market sentiment is that we are likely to see a handful of bank rate reductions this year. This is shaping the interest rate environment for those looking at tying up cash deposits.

Those of you that have been keeping your eyes on rates will have noticed that 12-month fixed rates on offer for schools are now available paying around 5%. This is down from their peak, just a few months ago, of more than 6%.

Traditionally, instant (or easy) access deposits tend to attract the lowest interest rates, however, we are seeing a number of banks paying over 4% at the time of writing.

The majority of the market-leading rates are offered through deposit platforms. This allows a bank to maintain its current deposit rate strategy through its branch network while allowing it to be competitive to ‘rate hunters’ by offering exclusive deposit accounts that can only be accessed and transacted on through a deposit platform. The platform also allows schools to open multiple accounts with multiple banks without providing any further ID and address verification once the platform is set up.

With schools generally having peak balances three times a year, a deposit platform providing an easy way to deposit cash on a short-term basis can make a significant impact on deposit returns.

Support, ideas and guidance on your deposit strategy, is available to readers of Independent School Management without charge via Ian Buss.

The example rates shown were correct at the time of writing (5 March).

Ian Buss is founder of Education Banking Consultancy.

Ian Buss