Cashing in

Ian Buss

Interest rate rises are prompting shrewd bursars to make use of deposit platforms, says banking expert Ian Buss

It is well known that there are a huge number of economic pressures on the independent school sector. With inflation increasing the school cost base, as well as affecting the disposable income of our parents, with potential VAT imposition on the horizon and a relentless rise in interest rates since the end of 2021, there are plenty of issues to focus the attention of bursars nationwide.

A rising base rate is making borrowing more expensive for schools and creating a ‘mortgage payment time bomb’ for parents who are exiting longer-term fixed rates over the next 12 months.

COST AND INCOME CONTROL IS CRITICAL FOR THE SECTOR

One thing that hasn’t kept up with the pace of the increase in bank rates is the return offered by banks on their deposit accounts.

Banks partly rely on lethargy among their customers. It’s often claimed that you are more likely to get divorced than change your bank account. Add to that the difficulty faced when trying to search for banks that take deposits from schools and then actually trying to open an account, it’s not difficult to see that there’s no real incentive for the ‘Big Four’ to increase their deposit rates at the same pace as their borrowing rates.

A significant amount of income a bank makes is generated by rate margin – the difference in rates at which they lend money compared to the rates they pay for deposits. As rates have increased, the opportunity for banks to grow that margin has increased.

Schools with healthy reserves will often trust their long-term investments to a fund manager, often shorter-term cash reserves and operational cash are left without much focus.

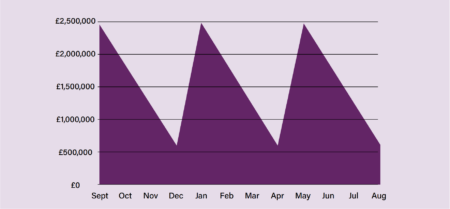

Short-term cash reserves and operational cash can be quite sizable. If we take an example of a school generating £7.5 million a year in fee income (collecting fees at the start of each term), its cash flow could look something like the graph below:

This leaves a significant amount of cash sitting in a current account, probably earning close to zero.

Having worked in the banking sector for 35 years, focusing on the education and not-for-profit sectors for the last 20, I have supported hundreds of independent schools and academies in reviews of their deposit strategy with a view to increasing significantly the amount of interest generated for their money. The past year has seen a significant growth in appetite from schools hoping to maximise returns as the bank rate has risen.

DEPOSIT PLATFORMS

A deposit platform is a technological offering to overcome the need to produce an ID and address verification while completing an application form each time you want to open a deposit account. The platform provider verifies the school and its chosen signatories and then allows the school to open deposit accounts with a multitude of banks directly from a single, online platform.

With the increased use of deposit platforms, hundreds of schools have removed the biggest barrier to shopping around as the school is free to use the platform to open new accounts at will, alongside using its existing accounts.

You will often find that banks offer an enhanced rate of interest for accounts opened through one of these platforms compared to going directly to the bank.

The reason for this can be twofold. First, it is a ‘low cost to serve’ method for the bank to collect deposits. After all, there’s no need for the services of a relationship manager or a branch, so deposits can be managed at lower costs. In addition to this, banks know that someone considering a deposit platform is looking for a competitive rate so they will often put their most competitive rates through the deposit platform, knowing that the majority of their existing clients are unlikely to be exploring these higher paying options.

NEW FORCE

While deposit platforms have been used in the UK for many years by companies and individuals, they are a relatively new consideration for the school sector. If this is an area you would like to explore, here are several questions to be considered:

1. Does your investment policy cover short-term cash deposits? If it doesn’t, then you should consider creating one. A policy should be specific and not open to wider interpretation, giving you clear guidance on the type of institution you can place deposits with.

2. What happens if the deposit platform goes bust? Make sure the platform you use holds your funds in accounts in your name or as client accounts (much like a solicitor’s client account), ensuring that the funds are yours and that any liquidator could not use them if they need to wind the company down.

3. Security of withdrawals and deposits. It makes sense to choose a platform that allows you to stipulate ‘dual control’, that is, two people authenticate each transaction.

4. Which banks should I choose to place deposits with on a platform? Your investment policy for cash deposits needs to stipulate the criteria in place for you to place funds (for example, jurisdiction, credit ratings etc).

5. Is it financially worthwhile? As at 30 June 2023, some instant access accounts were paying over 3% and some 12-month fixed rate deposits were paying around 6.5%. If these rates remain unchanged for a year and you kept a deposit of £1 million in them, this would give you an indicative return of somewhere between £30,000 and £65,000 over a year.

A selection of interest rates from a variety of banks on one deposit platform is detailed below. These rates were correct on 30 June 2023 and the indicative returns* assume that rates do not change and funds are left for a full year at these rates.

For any school with an element of surplus cash, it makes sense to explore a wider range of deposit options to help offset some of the cost pressures that are being experienced now as well as those on the horizon.

Next Steps:

1. Review your cash flow forecasts to understand your level of cash for potential deposits.

2. Ensure you have a robust investment policy that covers cash deposits.

3. Consider a deposit platform to help you maximise your deposit interest earned while minimising the administration of account opening and management.

Ian Buss runs the consultancy Education Banking Support – linkedin.com/in/ianbuss