How to make the most of teachers’ pensions

Caroline Gaines

As potential mitigation to the unrest from the consequences of TPS changes, there’s a way of adding to teachers’ pensions without cutting take-home pay. Caroline Gaines of consultant Punter Southall Aspire explains

Advising people on pensions isalways a tension between the urgent – the here and now, and the distant – the important, but far away. And for advisors that means thinking about, consulting on, writing about and resolving the challenges it poses to employers, trustees and members.

One such discussion in the independent school sector is the burden imposed on bursars and governors by The Teachers’ Pension Scheme or Scottish Teachers’ Pension Scheme (both referred to hereafter as TPS).

The increases in contributions employers (independent schools) have had to make, and which will almost certainly continue to rise, mean this is one conversation set to run and run in budget meetings, staffrooms and beyond.

It’s important that schools should have an outline of the options open to them, regardless of whether or not they decide to move out of the TPS into an alternative. In the end, everyone needs to see (with apologies to maths teachers) the pluses and minuses before reaching a conclusion.

Which brings us to salary sacrifice, a mechanism for improving take-home pay while making the same level of pension contributions. Not only is this a good thing for the staff involved but it also gives bursars more flexibility by reducing National Insurance contributions which can then be redirected into, perhaps, higher employer contributions or other benefits.

On the upside

While salary sacrifice cannot be used by the TPS, it is an illustration of what the alternative can look like both for schools and their staff.

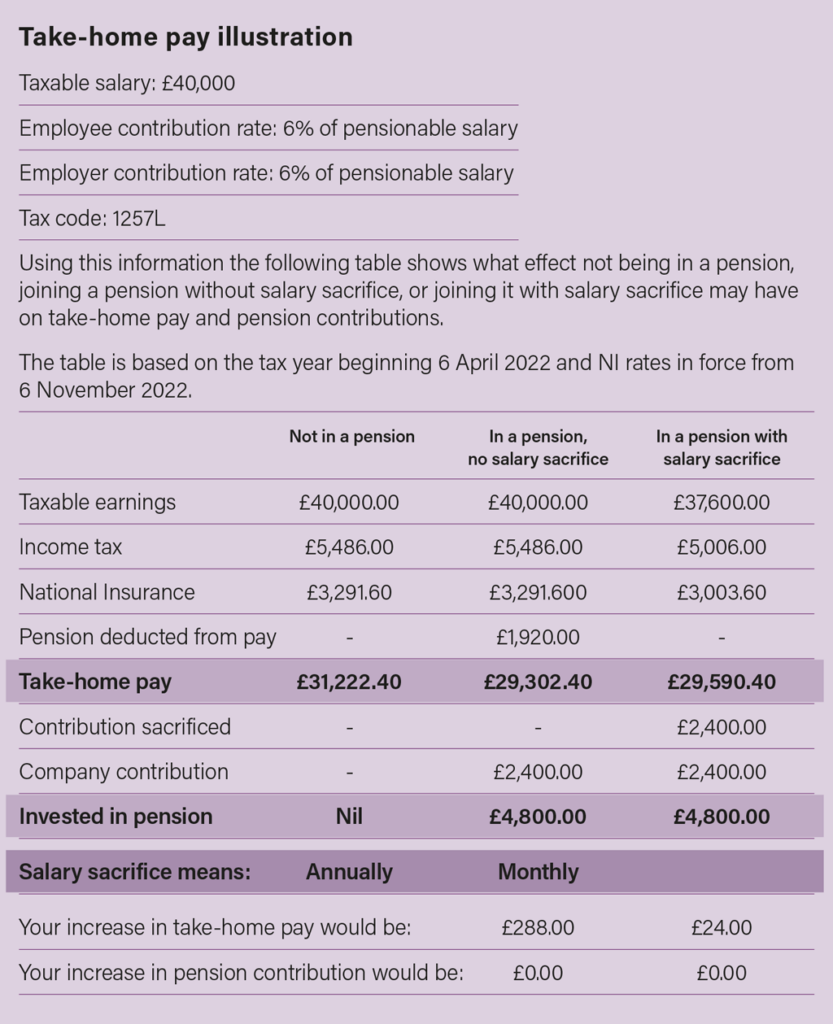

The table below shows three different ways to slice the same employee pension contribution and the associated tax relief and National Insurance contributions, each with a very different outcome.

“If this were your own pension contribution, which option would you choose?’, might be a better way in which it can be framed.

So why doesn’t everyone use salary sacrifice for pension contributions?

As made clear, TPS and other related funds, including the Scottish Teachers’ Superannuation Scheme, cannot do so.

It’s another important reason to shop around if you are considering your school’s future in the teachers’ schemes, making sure any new pension offers your school and your employees access to options like this that can make a material difference to contribution costs and members’ retirement savings.

On the level?

There are less concrete issues as well, like the fact some employers think it’s a grey area legally.

This perception wasn’t helped by some of the headlines that followed the government’s announcement in 2016 that it was cutting back on the range of benefits that can be provided via salary sacrifice.

For example, since April 2017, no new salary sacrifice can be set up in respect of mobile phones, accommodation or school fees. However, the government also specifically confirmed salary sacrifice for childcare vouchers, pensions and cycle-to- work schemes are to be retained.

There’s also the belief this kind of thing can be costly to establish, but our experience shows it can be quickly recouped through savings in National Insurance contributions.

It’s one of the key areas we recommend employers check as part of a wider feasibility exercise before deciding whether salary sacrifice is right for them and their people as, by itself, it’s not a reason to transfer.

Tricky to follow?

Another concern can be that it seems hard to grasp, difficult for payroll, and a benefit that not many understand. Do those doubts surface when it comes to talking through salary sacrifice for childcare vouchers and cycle-to-work schemes?

Maybe they do, but we tend to think that when the word ‘pension’ is written or spoken alongside ‘salary sacrifice’, people immediately seem to feel matters are more complicated – even though they aren’t.

In summary, while salary sacrifice can still be used alongside a range of employee benefits, the largest gain for most organisations and workforces comes from applying it to pension contributions.

It allows employers to control costs and, ultimately, help employees save while, at the same time, taking home more in their pay packet.

This is a conversation which will always be worth having, no matter how far away the distant yet important seems.

Notes to table

Based on an assumed tax code of 1257L.

All figures are annual and are intended only as a guide to the level of additional benefits received. They are not a guarantee of the savings that would be available. Any other earnings or deductions to pay that have not been provided have not been included and may affect the figures. Additionally, employers can use slightly different methods of calculating NI that could lead to a small difference between the figures shown here and on a payslip.

Anyone aged over state pension age, and not paying National Insurance contributions, using salary exchange will not generate any increase in take-home pay.

Before entering into a salary sacrifice arrangement, employees should be satisfied about the impact upon their entitlement to state benefits or statutory benefits. Further information can befound in their scheme employee guide.

If they use salary sacrifice, their payment will be deducted from their salary before the calculation of tax and will therefore receive automatic tax relief at the highest marginal rate.

If they contribute without salary sacrifice, their contribution will be deducted after the calculation of tax and will be net of basic rate tax. It will then receive automatic tax relief of £480 once it is paid into the plan.

Caroline Gaines is a principal, employee benefits, at Punter Southall Aspire.