Keep the money flowing

Stewart Ward examines the impact of household cash flows on your school’s cash flow

During these uncertain times, schools must safeguard their income. Collecting school fees in a timely and efficient manner is a top priority for bursars and finance teams to maintain a steady cash flow; failure to do so can lead to long-lasting negative consequences.

School fees can be a significant expense for parents, especially with the current high cost of living. Careful budgeting is necessary to fund a child’s education at an independent school. The cost of privately educating a child from reception to A-levels is an average £355,516 in a day school rising to £514,594 if they attend a day school to 11 and then board.

Affordability

What percentage of parents currently paying their children’s school fees are juggling their finances, or may struggle in the future? The numbers experiencing some challenges in paying may be higher than you think. The current economic environment is hitting parents hard.

Findings from the Independent Schools Index indicate that nearly a third (31%) of parents believe affording fees will become much harder in the future, while 28% believe paying fees will become slightly harder. This is a major consideration for independent schools throughout the UK. School fees are typically their primary source of revenue – any change in cash flow could significantly affect the way a school runs. Consistent income from fees ensures financial stability, allowing schools to cover operating expenses, run smoothly, and flourish.

How are parents covering school fees?

The Index findings indicate that 47% of parents admit to relying on financial support from family to meet school fees, with grandparents the biggest source of funding. Nearly four out of five (79%) who receive family support say grandparents help with some of the fees, while 38% say some help comes from aunts and uncles.

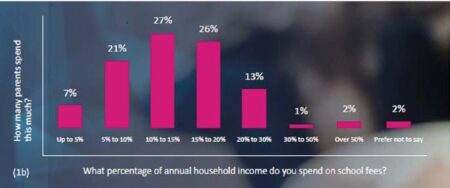

Pressures on household income creates tension and concern, particularly when it comes to funding big-ticket items like school fees. 42% of parents are paying in excess of 15% of income with some paying over 50%. 48% are paying somewhere between 5% and 15% of income.

School cash flow constraints and pupil demand

So what does this challenge on household cash flow mean for schools? Around half (48%) of headteachers, bursars and finance managers are very concerned about a rise in children leaving their schools because their parents can’t afford the fees.

Affordability could become a wider concern if political changes take place following the upcoming general election. VAT could be added to school fees heaping more financial pressure on parents and on schools relying on this income.

Already, more than four out of five (83%) say their schools are spending more time chasing parents for payment of fees. The future demand for bursaries and hardship funds will not be able to fill the gap.

The importance of maintaining income from school fees

Financial stability is key to the day-to-day running of an independent school, but what else can be affected?

Quality of education – timely funding from school fees enables independent schools to provide the ongoing, high-quality and comprehensive learning experiences the sector’s schools are renowned for. A robust and steady income from fees allows schools to invest in small class sizes, highly qualified teachers, modern facilities, technology integration, and enriching programmes, all aspects which attract future generations.

Autonomy and independence – independent schools rely on tuition fees to maintain their autonomy and independence from government funding or oversight. This financial independence grants schools the freedom to develop unique educational philosophies, curricula, and teaching methodologies tailored to their mission and the needs of their students.

Competitive advantage – a stable income from school fees allows independent schools to remain competitive in the education marketplace. It enables schools to attract and retain talented faculty and staff, upgrade facilities, offer scholarships and financial aid, and invest in innovative educational programmes and resources that distinguish them from other schools.

Long-term planning and development – reliable income from school fees allows independent schools to engage in long-term planning and development initiatives. It enables schools to make strategic investments in infrastructure, technology and professional development that support their mission and ensure continued growth and improvement over time.

These points will be familiar to you all. Maintaining income from school fees is crucial for the sustainability, quality, autonomy and competitiveness of independent schools, enabling the fulfillment of educational missions and providing an exceptional learning experience for pupils.

These are all thought-provoking points and will resonate with leadership teams in different ways, but whatever your situation, school fees need to remain affordable to parents so valuable income to schools can be maintained.

How can this be achieved?

Payment plans are an increasingly popular option among parents allowing them to pay annual school fees in convenient, more affordable monthly payments rather than having to meet the cost in one, large termly or annual lump sum. A 0% option can also be offered to parents.

Parents paying fees in instalments benefit from:

- Spreading school fees and extras like music lessons and school trips over monthly payments (up to 12 months), maximising their monthly disposable income.

- Certainty of outgoings with monthly repayments accurately tracking their termly bills.

- Competitive transaction fees.

- Discreet, simple, paperless online application with an immediate decision.

- No need to reapply each year. Once set up, an instalment plan can run automatically until parents choose to leave the scheme.

- Rates can be fixed for the academic year with no penalties for early exit; parents can leave at the beginning of any term.

An instalment facility is also a smart way for schools to secure income too. Participating schools can receive fees in full at the start of each term directly from a lender, helping to maintain a strong cash flow.

Schools can also benefit from:

- Reduced administration and costs. Parents can apply directly to the lender.

- Reduced regulatory risk; the lender takes responsibility for regulatory compliance.

- Reduced bad debts and debt management costs.

- Potential to increase pupil access to your school.

- Improved cash flow freeing up cash tied up in in-house schemes to invest in vital capital projects.

- Opportunity to receive the academic year’s full fee funding in one amount in either September or October.

Paying school fees – the future

Spreading the cost of school fees over convenient payments is becoming a ‘go to’ option for parents. It’s widely used from an affordability and efficiency perspective and for schools it provides a smooth, reliable, and regulatory-compliant cash flow. In the current climate, the parents we have spoken to are keen to better manage their finances and are interested in new payment solutions, even though they may be too concerned to tell the school.

The consequences of financial failure or underfunding are hard to contemplate for any school but must be considered. Creating a strong financial environment is critical – an outsourced school fee finance facility is a strong option to achieve this.

The Independent Schools Index is a School Fee Plan project that examines the economy and the impact it is having on how parents from across the UK pay for their children’s school fees. Areas covered include the cost, financial pressure on parents and how they fund school fees.

Stewart Ward is director, education sector and head of School Fee Plan.

Stewart Ward