Merger watch – August 2025

Siân Champkin, a partner at law firm VWV, observes a strategic surge

It will come as no surprise that over the past few years, we’ve seen a notable acceleration in merger and acquisition activity across the independent schools sector. However, what we are currently experiencing – by example, exchanging/completing a record number of transactions (12 to be precise) in just a two-week period after Easter – is exceptional by any standard,

We believe VWV generally advises on more than 75% of the transactions in the sector – 20 of the 23 announced up to May this year. As such our current activity level represents a significant proportion of the activity in the sector so can generally be considered as reflective of it as a whole. It’s been quite a year so far.

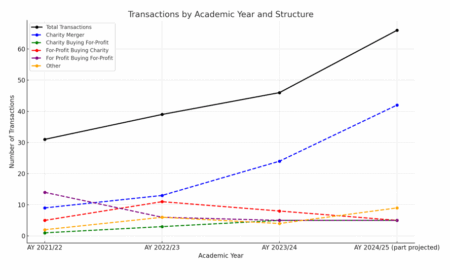

What the table below illustrates is the significant uptick (even on a steadily increasing line) that the academic year 2024/25 looks set to deliver. What was once a path for struggling schools has increasingly become a mainstream strategic option for those looking to secure long-term sustainability, diversify income, or enhance their educational offer.

In particular senior schools appear to be doubling down on their efforts to secure pipeline and scale and we are seeing this keenly reflected in transaction numbers.

Transaction volumes have risen steadily. From 31 in 2021/22 to 39 in 2022/23, and then 46 in 2023/24, the trend is clearly upward. This current academic year is already tracking at 66 transactions – some completed, others in progress – and the momentum is continuing to build. As a result, more governing bodies are exploring mergers and acquisitions proactively, rather than reactively. Increasingly, we’re seeing competitive processes being launched to identify the right partners – not just for financial reasons, but to find a strong cultural and strategic fit.

While charity-to-charity mergers remain the dominant model (in particular, a surge of prep schools joining senior school ‘families’), the deal structures have also become more varied. There’s a clear uptick in hybrid transactions – commercial operators acquiring charitable schools and vice versa – an illustration of rising fluidity between sector segments. This crossover reflects a more pragmatic and mission-driven approach from schools – the priority is increasingly about securing the right outcomes for pupils, staff and communities, regardless of structure.

We are also seeing more schools engage in transactions as part of a diversification strategy. Acquiring businesses allows schools to broaden their income base and reduce reliance on traditional fee income. In the face of rising VAT exposure, employment costs, and fluctuating pupil demographics, these moves offer a more resilient financial foundation.

A key shift we’ve noticed is the timing of decision-making. Schools that begin strategic conversations early – while still financially viable and mission-secure – tend to have more control over their options. Governing bodies are increasingly recognising that delaying strategic decisions often narrows options and elevates urgency. Waiting until circumstances become acute can significantly limit the ability to shape the future. That’s why early engagement, especially with legal and strategic advisors, is so critical to good outcomes.

Looking ahead, we expect transaction activity to remain high through 2025 and, based on current new instructions, beyond. Charity mergers will continue to form the bulk of the market, but cross-structure deals are likely to grow. Schools will also increasingly use M&A as a means to diversify revenue and futureproof their operations.

The market is evolving quickly. For many schools, the question is no longer whether to consider a transaction – but when, how, and with whom. Those that approach the process with clarity, openness and strong governance are the ones best placed to emerge stronger.

Siân Champkin