Merger watch – December 2024

Law firm VWV partner Siân Champkin reflects on transactions from the 2023/24 academic year to identify trends

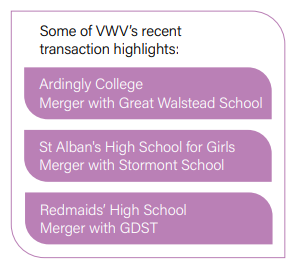

As anticipated, 2023/24 was extremely busy for the education transactions team at VWV and across the whole sector. In total, we advised on 46 independent school transactions.

While VWV, of course, does not advise on every independent school transaction, we do act on a large proportion of them and thought it might be helpful to share some of our transaction numbers below to illustrate wider sector trends.

| Number of deals | Total deals | Live | Completed | Aborted |

| 2021/2022 | 31 | 11 | 19 | 1 |

| 2022/2023 | 39 | 24 | 15 | 0 |

| 2023/2024 | 46 | 24 | 22 | 0 |

| Deal structure | Charity merger | Charity buying for-profit | For-profit buying charity | For-profit buying for-profit | Other |

| 2021/2022 | 9 | 1 | 5 | 14 | 2 |

| 2022/2023 | 13 | 3 | 11 | 6 | 6 |

| 2023/2024 | 24 | 5 | 8 | 5 | 4 |

| Target type | Independent school | Day nurseries | Online school | Language school | Children’s home | Other |

| 2021/2022 | 24 | 4 | 1 | 1 | 1 | 0 |

| 2022/2023 | 33 | 2 | 1 | 0 | 0 | 3 |

| 2023/2024 | 37 | 6 | 0 | 0 | 0 | 3 |

The numbers show an increase in the number of active matters which, from conversations with other advisors, is certainly being felt across the whole of the sector. Mergers, or the contemplation of them, is on (or should be) every governing body’s agenda. Discussions regarding mergers that were ongoing or had been in early contemplation are generally accelerating.

The increase in prep schools seeking to join another school or group, added to a renewed appetite for mergers by many senior schools, is further driving merger activity. Therefore, particularly where a prep school is in a strong position, we are seeing competition among senior schools and/or groups for that school to join them. In connection with that interest, we are seeing a more formal tender processes being undertaken to elicit more considered and detailed offers.

While a large number of the transactions noted were charity-to-charity mergers, which continue to make up the majority of our work, we also saw a notable increase in transactions involving commercial acquisitions or sales by charities, highlighting the ongoing trend of greater interaction between different parts of the sector.

Another interesting trend emerging is the increasing number of acquisitions of commercial operations by charitable independent schools looking to diversify their income and take a more commercial approach (illustrated by the ‘target type’ in the final table). The types of commercial businesses acquired vary, but include nurseries, language centres, online learning providers and outdoor centres to name just a few, showing a considered diversification strategy being taken by a number of schools.

Siân Champkin