Strong consolidation drives growth in K12

As the world emerges from the pandemic, growth opportunities for premium K12 schools are expected to flourish, with the development of large platforms able to accelerate consolidation across the market, while providing high-quality education and sound business models.

With its resiliency, solid revenue generation and high entry barriers, the sector has become an attractive investment opportunity for a growing pool of operators and investors globally.

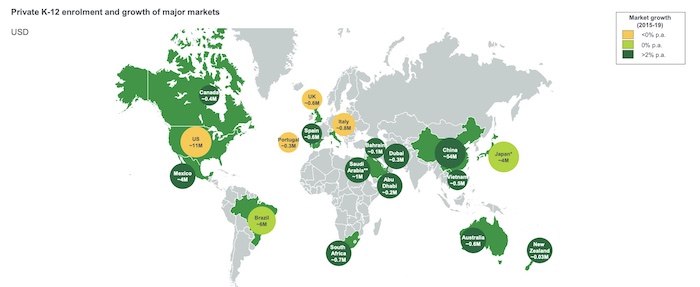

According to “Good as Gold“, a recent LEK study on K-12 trends, between 2015 and 2019 private K-12 institutions gained considerable shares over public schools across major markets, growing at a CAGR of 2-3% and enrolling close to 85 million students. This market share is expected to further grow in the coming months, according to the study.

“Barring a few cities – primarily Dubai and Abu Dhabi – the current private K-12 market share across major cities in Africa, MENA, APAC and Europe ranges between just 15% and 25%, which implies significant headroom for expansion, especially in light of growing demand,” said Chinmay Jhaveri, partner at LEK Consulting’s Global Education Practice.

This rising trend has been driven by the poor quality of public provisioning and an increase in the affluence of households in emerging markets.

Moreover, the ability of private K-12 schools to better ensure continuity and maintain learning outcomes during the pandemic has further strengthened the ongoing privatisation of education.

Market potential High entry barriers due to brand recognition and regulations, as well as structural financial advantages including long-term revenue generation, negative working capital requirements and predictable cash flows, have also increased the allure of this market.

Even more significantly, investors have been attracted by the wide scope for consolidation that the sector offers. According to the LEK’s study, large global K-12 platforms account only for around 10-15% of the market, while the rest of the international schools are run as standalone, family-controlled businesses.

“Larger global K-12 platforms can drive capacity optimisation, increase further enrolment growth, and exploit fee growth opportunities by implementing best practices across academics, extracurricular activities, and infrastructure,” said Jhaveri.

The most attractive opportunities for aggregation and further growth are within the premium international and bilingual segment, which has demonstrated greater resilience than the overall private K-12 segment during the pandemic.

“Growth in affluence and increasing affordability on the back of an increase in white collar salaries have driven the demand for premium schools,” said Jhaveri. “Large operators that control established platforms are particularly well-positioned to tap into this segment.”