New VAT rules could hike school fees by £75,000 per family

The Government’s controversial decision to introduce VAT on private schools will introduce a price hike in excess of £75,000 for families, according to new analysis by wealth manager, Rathbones.

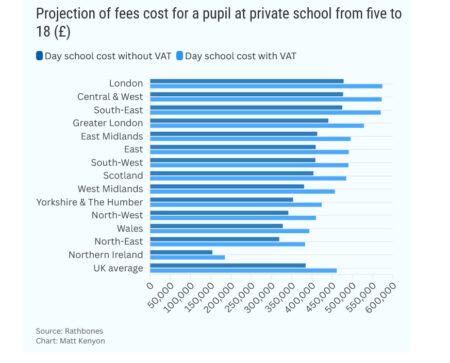

According to the recently-released data, the average cost of sending a child to an independent day school for the duration of their time at school could soar to £461,431 – up from £384,526 – following Labour’s removal of this tax exemption.

Rathbones points out that, for a couple earning £150,000, this total would amount to their entire post-tax income for four years and three months.

For parents looking to send their children to boarding school, the price hike would be steeper still – an additional £111,317, bringing the total average cost up to £667,902.

The research suggests families would be particularly hard hit in Central and the West of England and the South-East.

Fees are the highest in London, which would see a £95,675 uplift for day school fees and £129,533 extra for boarders.

Northern Ireland – which already has the lowest private school fees in the UK – would see the smallest rise, up £30,802.

Faye Church, Rathbones’ senior financial planning director, said: “The impact on parents’ finances over a child’s school career of adding the full 20% VAT to fees is substantial and may mean some will decide they cannot afford the expense or need to consider other ways in which to manage the costs of the education for their family.

“However, it was already the case that funding a child through private school is a major commitment with the average total cost at around £380,000 for day schools and £556,000 for day and boarding schools before any VAT is applied to school fees.

“If there are several children, of course this will multiply, and we’re hearing from families who are very concerned and helping them plan for this.”

Labour’s controversial policy has led to legal action, with campaign groups – including one representing children with special educational needs (SEN) – slamming the tax as ‘cruel’.

Earlier this month the High Court heard objections to the policy and is expected to report its findings within days.